Selling our Atlanta home wasn’t just the end of one chapter. It was the beginning of a strategy that took our retirement nest egg out of the US and into a South African property “empire”—maybe the best financial move we ever made. Higher yields… rising values… and even a dream river cottage are now ours to enjoy.

International Living subscribers who see my articles and videos about global diversification might doubt whether I “walk the walk.” I do… and my recent investment decisions prove it.

Let’s start with some recent history about yours truly.

In 2008, my wife and I moved from Cape Town to Atlanta so I could take up a position at a US nonprofit. We kept our home in Cape Town, always intending it to be a temporary move.

We started out renting in Atlanta. Just as we arrived, however, the US financial system fell apart. House prices collapsed. Thanks to the subprime mortgage crisis, there were foreclosed homes everywhere… except the little town of Decatur, Georgia, where we lived. Although prices had dropped, there was nothing in our price range.

But on January 3rd, 2012, our landlord called. He said he’d decided to sell our place, and we had first option to buy. But it was still too expensive. So, I started looking for something we could afford, hoping we could stay in Decatur since our daughter was in the school district there, which was excellent.

I immediately found a foreclosed property owned by Fannie Mae, the federal housing finance corporation—the only one in Decatur. At the time, the government was willing to sell such properties for what was owed on the mortgage, not their market value, if buyers were first-time homeowners. Since we’d never owned a home in the US, we qualified.

That’s how we acquired a US property for about half what it was worth… at a miserly mortgage interest rate of 2.99%.

Fast forward to January 2025. We’d lived in the house until 2022, when we returned to Cape Town. Since then, we’d toyed with the idea of selling it and reinvesting the proceeds in a multi-family unit in Atlanta, which would generate pretty good cash yields. But the outcome of the elections that year made me worry about a decline in the relative value of the dollar. Maybe keeping assets in the US wasn’t the best idea.

The decision was a big one for my family. Most of my career had been spent in Cape Town, in the nonprofit sector. I didn’t have any pension savings from that. I did have an IRA from my time working in the States, but it was less than a decade old and wouldn’t sustain us. The proceeds from the sale of our Atlanta property would form the basis for our retirement.

After much internal debate, my wife and I decided to invest in real estate here in Cape Town. In retrospect, the decision was a no-brainer:

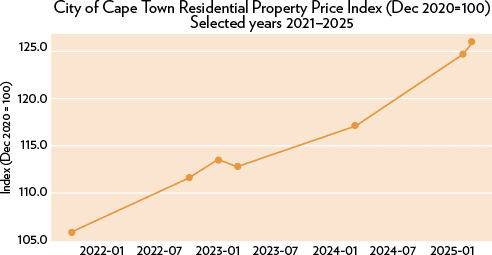

Residential property prices were rising much faster in South Africa than in the US. We’d be getting excellent cash yields immediately:

With US dollars to spend, we could afford multiple properties. Since we wouldn’t need to take out a supplementary mortgage—as we’d need to do had we bought a 4-unit Atlanta condo—we’d have no interest costs.

The capital value of local properties and their cash yields would be out of the US dollar, so we needn’t worry about its decline.

We’d be dealing with local property managers. Managing that relationship from afar for our portfolio of properties had proved tricky.

We wouldn’t need to worry about the cost and hassle of transferring rental income from the US to South Africa.

The World’s Best Retirement Havens for 2026

The World’s Best Retirement Havens for 2026

24 Countries Compared, Contrasted, Ranked, and Rated. You don’t have to be rich to enjoy a pampered retirement, you just need to know where to go. With our 35th Annual Global Retirement Index, our experts hand you a detailed roadmap. Details—and a Special Offer—Here

By submitting your email address, you will receive a free subscription to IL Postcards, Overseas Dream Home, The Untourist Daily and special offers from International Living and our affiliates. You can unsubscribe at any time, and we encourage you to read more about our Privacy Policy.

Exchange Rates Matter

Our Atlanta property sold quickly, leaving us with a big capital gain. The first question was what to do with all that cash, given that we’d earmarked it for investment in South Africa.

Our first instinct was to put it into a high-interest savings account in the US. But the best we could find was 3.5%, an American Express savings account. By contrast, South African savings accounts were paying nearly 8%, and with SA inflation at around 3%, that meant a 5% yield on our savings.

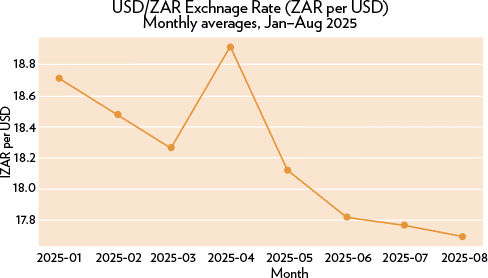

But then geopolitics intervened. Financial markets were initially thrilled with the new administration in Washington. No sooner had we transferred the sale proceeds into the Amex account than the rand tanked against the surging dollar. With every day that passed, it seemed that we’d lose more and more potential purchasing power due to the exchange rate.

Fortunately, I had an account with Wise.com. We decided to transfer our US dollars from the Amex savings account to a Wise dollar account. Even though it didn’t pay any interest, having the dollars on the Wise platform meant we could take instant advantage of any exchange rate moves in our favor, instead of having to wait for the tedious process of transferring money from Amex to our USAA bank accounts, then transferring dollars to SA in small chunks because of transaction limits.

In retrospect, that was an excellent decision. After President Trump’s “Independence Day” tariff announcement, the dollar collapsed. I quickly transferred our dollar balance at Wise into rands to maximize our balance.

I managed to time it almost perfectly, doing the conversion at the beginning of April when the rand was at its peak. Those extra rands fully covered all our transaction costs for the purchases that were soon to come:

Our 3 Goals

South Africa’s digital economy is well-developed, and the housing sector is no exception. Using multi-listing service Property24.co.za, we signed up for alerts for properties that met our goals. These were:

Price under $100,000.

Potential gross rental yield of at least 10%.

Near our own home so it’s easy to keep an eye on things.

The last one was the easiest to meet. Our Cape Town home is near a cluster of gated housing developments built over the last 20 years. The combination of security, accessibility, and relative low cost is attractive to younger middle-class families. And because there are so many properties in that area, there’s a lot of turnover, so we were confident in property prices in a competitive market.

Once we started looking, we quickly identified the most desirable developments. As one would expect, the closer to the beach and the younger the development, the better the rental prospects. That helped us narrow down our choices.

But it also helped to have a good relationship with a local property agent. We’d been using one for years to manage the rental of our own home when we were abroad. They identified half a dozen developments that rent at a premium. They also gave us insights into how to handle the relationship with homeowners’ associations, which applied to all the developments we were considering.

One thing we learned immediately is that it’s critical to have money in your local bank account when you start shopping. Housing is in short supply in Cape Town—the big rise in property prices over the last few years is due to intense competition from buyers. The first place we wanted slipped through our fingers because another buyer offered an immediate cash deposit while we were waiting for our inward transfer from Wise.

Our 3 New Properties

Once we had enough funds in our local account to move quickly on 2-3 properties, we were ready for success.

That came surprisingly quickly. Because we were looking for rental properties in a dense residential area, the houses tended to be similar. We soon knew the layouts on offer, and the various combinations of house, garage, carports, yards, and so on. We found that even though some properties lacked certain amenities, their rental potential was higher because of what they did have.

Our first purchase was a three-bedroom double-story condo with a garage. We made an immediate cash offer, which was accepted. It turned out that the sellers were emigrating to Europe and in a hurry to sell.

Two weeks later, we bought a second property in the same little development. It was a single-story with only two bedrooms, and no garage, but it was the same price as the first. That confirmed that we’d saved a lot of money by chancing upon a property whose sellers were in a hurry.

After cleaning the places up and fixing a few things, the properties went on the market, managed by our estate agent friends. They had them rented almost immediately. In less than a month after taking the transfer, we were earning rental income.

At that point, my wife—typically low-key when she tries to convince me of something—suggested we buy a third property outside Cape Town that we could use as an Airbnb and as a weekend home for ourselves. I’d always had a hankering to own a property in the Breede River Valley about three hours outside Cape Town, so off we went to explore that market.

We were once again in luck. The second house we viewed was a magical wooden cottage built on a slight slope overlooking the Cogmans River in the village of Ashton. It was right on the boundary of the municipality, and all the property between us and the mountain range on the other side of the river was a wine farm. The front stoep (porch) faces the sunrise.

The sellers had built the house themselves, and it was largely off-grid. The electricity supply was solar, as was the hot water heater. Only the water supply and sewer were from the municipality. That meant our monthly property taxes would be minimal.

We doubled our cash yield compared to the US.

We quickly put in an offer a bit below the seller’s asking price, which was accepted. A month later, we started moving into our new dream weekend home.

All in all, our decisions had led to three new homes with enough cash left in the bank for two more should we choose to invest in more property. We’re earning a 10% cash yield on the two rental properties already, which will quickly rise over the next few years.

4 Takeaways

Although the specifics will differ from country to country, I learned some valuable lessons that apply to buying foreign property anywhere:

Although property markets in different parts of the world sometimes synchronize, individual countries and regions within them offer great opportunities, but only if you go looking for them. Our decision to search for rental properties in the rapidly growing rental market near our home in southern Cape Town meant that we more than doubled our cash yield compared to investing in the US.

Once you’ve decided to look for property, it’s important to have local ammo when you go shopping. Property markets with rapid turnover often see houses selling immediately, and whoever can make the down payment first gets the title.

Having a money transfer solution that we were already familiar with gave us confidence and allowed us to move quickly when the time came. Had we not used Wise.com, we’d almost certainly have lost our bid on the first property, paid a lot in transaction fees, and missed some great exchange rate opportunities given the volatility of the dollar.

Be patient. Although we were able to move quickly because we are intimately familiar with our target market, if you’re not living in the country already, it’s important to take your time to find exactly the right properties to meet your goals. We had some support from a local property agent, but if we weren’t living in Cape Town at the time, we would have had them manage the entire process for us.

Our decision to move the bulk of our investable retirement savings outside the US was an easy one for me. After all, I pay close attention to these matters as part of my consultation service here at IL. If you’re thinking about following in my footsteps, give me a shout, and let’s talk.

Consult with Me, One-on-One

My Mission: To Make Your Life Simpler, Safer, and Freer … Not More Complicated

Stop overcomplicating, second-guessing, or giving in to “information paralysis” … Let’s sit down together (online), and I’ll help you create a custom blueprint for your international goals… second passports, tax, travel, retirement, estate, business, and more…

The World’s Best Retirement Havens for 2026

The World’s Best Retirement Havens for 2026

24 Countries Compared, Contrasted, Ranked, and Rated. You don’t have to be rich to enjoy a pampered retirement, you just need to know where to go. With our 35th Annual Global Retirement Index, our experts hand you a detailed roadmap. Details—and a Special Offer—Here

By submitting your email address, you will receive a free subscription to IL Postcards, Overseas Dream Home, The Untourist Daily and special offers from International Living and our affiliates. You can unsubscribe at any time, and we encourage you to read more about our Privacy Policy.