Two years ago, I stood on a golden sand beach in Los Cabos, Mexico, and announced the start of a special mission for me and my team of international real estate scouts…

We were going to fan out across the globe and find the "next places."

In the wake of the pandemic, many of the world’s most popular and desirable destinations—from Cabo to the Costa del Sol in Spain… from Portugal’s Algarve region to Mexico’s Caribbean coast, known as the Riviera Maya—were seeing unprecedented influxes of not just vacationers, but also digital nomads, snowbirds, young families, and remote workers…

As more people came and demand for real estate soared, I knew the opportunity would spread to new destinations… places off the typical tourist and expat paths.

So, for two years, my team and I have been on the road, driving rural routes in Spain, Italy, Portugal, and France… talking to brokers in the Balkans… meeting big-time developers in little-known beach towns on Mexico’s Pacific and Caribbean coasts… touring incredible new communities in the Dominican Republic and Costa Rica and Panama…

Now, after years of boots-on-theground research, I can say this: The era of the "next places" has arrived.

Across the world, people are beginning to hunt for quieter destinations that offer better-value real estate opportunities. As a result, a whole host of little-known towns and cities are on the cusp of exploding into the mainstream.

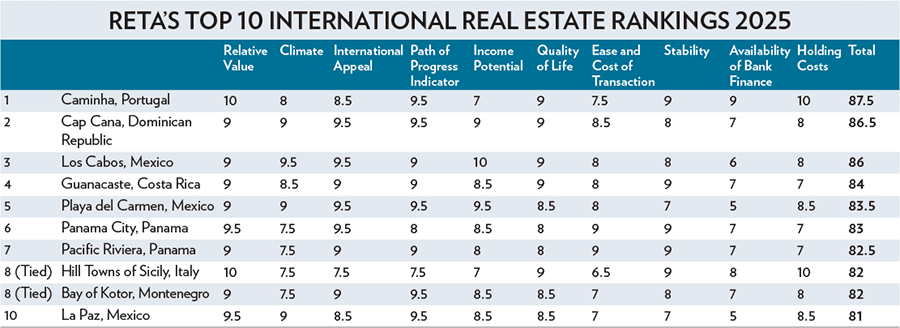

You’ll see this reflected throughout the just-released 2025 Real Estate Trend Alert (RETA) International Real Estate Index.

Topping the index for 2025 is the small town of Caminha in the far north of Portugal. This community is virtually unknown to the tens of millions of tourists who flock to Portugal each year.

But Caminha, alongside other towns and cities in the region north of Porto, has immense potential. So confident am I in the future of this town and this region that I’m in the process of spending around €410,000 on a historic mansion here. (More on that below.)

In second position on the index is the vast, master-planned community of Cap Cana on the Caribbean Sea. Billions have already been spent building this ultra-luxurious community… and billions more are set to be invested. This is a veritable city-state rising on the shores of the Caribbean, and yet I suspect many people are unaware of it.

Also in the top 10 are the overlooked coastal city of La Paz in Baja California… a 50-mile stretch of coast in Panama known as the Pacific Riviera that’s home to new luxurious communities… hill towns in Sicily that are being brought back to life by clever policies, but where you can still buy a historic home for less than the cost of a new car… and the stunning Bay of Kotor in Montenegro where billionaires park their mega-yachts…

Each of these destinations flies under the radar to some degree. Each is in the midst of, or primed for, a huge transformation.

All of this is not to say that the opportunity has passed in mainstream places like Cabo or the Riviera Maya, which make the list, too. Those destinations will continue to grow and develop.

But the opportunity in these destinations is now deal-specific. By that, I mean that prices in these locations are pushing higher on incredible demand. So, to own there and see excellent capital appreciation and high rental yields, you need to find just the right deal at just the right entry price. That typically means buying in an off-market deal, as members of my RETA group do.

With that, here’s a breakdown of the best places in the world to own real estate in 2025, and the factors driving opportunity in them…

Free Report: Best Places in the World to Buy Real Estate

Free Report: Best Places in the World to Buy Real Estate

Sign up for International Living's postcards and get the latest research on the best places in the world to retire. Including boots-on-the-ground insights on real estate and rental trends. Simply enter your email address below and we'll send you a FREE report - The World's Best Places to Buy Real Estate.

By submitting your email address, you will receive a free subscription to Your Overseas Dream Home and special offers from International Living and our affiliates. You can unsubscribe at any time, and we encourage you to read more about our Privacy Policy.

No. 1: Caminha and the Undiscovered North of Portugal

Located in the far north of Portugal, on the Minho River that separates the country from Spain, the charming town of Caminha has existed since Roman times. Walk its cobblestoned lanes and alleys, and you’ll see constant reminders of this rich history, from the 15th-century Igreja Matriz de Caminha church to the 13th-century Torre do Relogio clocktower, which stands watch over the town’s main square.

Yet despite all this history, Caminha often feels modern and upmarket. There are art galleries and boutique hotels, fine-dining restaurants and wine bars. Then surrounding the town you have the river, lagoon and Atlantic beaches, bucolic countryside, and lush rolling hills. Caminha has so much to offer, but like other towns and cities in the far north of Portugal, it remains overlooked and undervalued.

Over the past five to 10 years, Portugal has become one of the world’s most popular destinations for vacationers and expats. Throughout much of the year, tourists inundate popular destinations ranging from Lisbon to the Algarve, from the Silver Coast to Porto. But head 30 minutes or so north of Porto, outside the reaches of its extended metropolitan area, and all that fades.

Here, in what I call the "undiscovered north," you’ll find all the elements that make destinations to the south so appealing—incredible food… soft-sand beaches…rich history and culture. Plus, you have an amazing, temperate climate.

But because these destinations are virtually unknown to foreign tourists, expats, and second home-owners, prices in the region are astonishingly low when compared to the rest of Portugal.

Very soon, that will change. This region will be discovered. Prices will soar. But for right now, we have a once-in-a-generation opportunity here. It’s as though we have a time machine and can step back to Portugal’s southern Algarve region 30 years ago…or the Silver Coast region between Lisbon and Porto 20 years ago…before the explosion in tourist numbers and real estate prices.

Get Your Free Portugal Report Today!

Get Your Free Portugal Report Today!

Want to discover more about retiring with ease to Portugal?

Simply enter your email address below and we'll send you a FREE report - Explore the Old World in Laidback Portugal. You'll receive all the latest advice on visas, property and healthcare from our most recent research.

By submitting your email address, you will receive a free subscription to IL Postcards, Overseas Dream Home, The Untourist Daily and special offers from International Living and our affiliates. You can unsubscribe at any time, and we encourage you to read more about our Privacy Policy.

Here I’ve zeroed in on Caminha. But there are other destinations in the north that similarly have amazing potential, like the coastal city of Viana do Castelo and the river town of Ponte de Lima. I’ve been singing the praises of this region for well over a year now, since I first scouted it. Now I’m putting my money where my mouth is. As I write, I’ve just signed a contract to buy a home in Caminha.

This home is a stunning, historic mansion. I have a garden where I can see waves crashing on two beaches—one in Portugal, another in Spain. Inside, the home is immaculate, furnished with original pieces that came from Brazil with the first owners at the end of the 1800s. In total, the home spans around 5,000 square feet. But I got it for around €410,000. That’s just $90 per square foot! This demonstrates the insane value you can find here.

No. 2: Cap Cana, Dominican Republic

After Mexico’s Riviera Maya, the Dominican Republic gets the most tourists in the Caribbean region. And just like Mexico’s Riviera Maya, this country is smashing tourist records. Last year, it welcomed more than 10 million travelers. This year, it’s expected to see 11.5 million. That’s astonishing growth.

Most of these arrivals go to Punta Cana, easily the country’s biggest destination. And this is where you’ll find the stunning master-planned community of Cap Cana…

Ready to discover a hidden Caribbean gem?

Ready to discover a hidden Caribbean gem?

To discover more real estate opportunities in the Caribbean, sign up for your free report.

This hidden archipelago is eternally green…bursting with flowers: hydrangeas, juniper, and orchids…the land is so fertile anything can grow here: pineapples, sugarcane, and Europe’s only homegrown coffee.

Best part: there are (almost) NO Tourists on this island we call “Portugal’s Little Hawaii.”

Are you ready to learn more about this idyllic location? Sign up now to get your free in-depth report!

By submitting your email address, you will receive a free subscription to IL Postcards, Overseas Dream Home, The Untourist Daily and special offers from International Living and our affiliates. You can unsubscribe at any time, and we encourage you to read more about our Privacy Policy.

At 30,000 acres, Cap Cana is twice the size of Manhattan. And it’s just 10 minutes from Punta Cana International Airport, with regular flights across Canada and the American Northeast. Everything in Cap Cana screams luxury. It’s home to 5-star resorts… the largest inland marina in the Caribbean… world-class golf… incredible fine dining… state-of-the-art equestrian facilities…

The region’s biggest water park also just opened here, and its amphitheater was inaugurated by Elton John. There’s also a university campus, convention centers, a fire station, medical and veterinary clinics, high-speed internet, and over 62 miles of paved roads. And the setting is unrivaled. I’ve never seen sands so white, or waters so quintessentially Caribbean, as at the Juanillo Beach Club in the heart of Cap Cana.

The description "master-planned community" doesn’t do Cap Cana justice. This is a vast semiautonomous city-state of luxury. Already, billions of dollars have been spent to build these incredible resorts and facilities. But this is jus

t the first phase. The plan is to spend billions more. A highlight of the near future is the $500-million Juanillo Village. This is a lavish project with a Barcelona-inspired shopping street leading down to Juanillo Beach.

Cap Cana is a new city rising on the Caribbean. But by acting now, you still have an incredible opportunity to own on the ground floor here.

Free Report: Best Places in the World to Buy Real Estate

Free Report: Best Places in the World to Buy Real Estate

Sign up for International Living's postcards and get the latest research on the best places in the world to retire. Including boots-on-the-ground insights on real estate and rental trends. Simply enter your email address below and we'll send you a FREE report - The World's Best Places to Buy Real Estate.

By submitting your email address, you will receive a free subscription to Your Overseas Dream Home and special offers from International Living and our affiliates. You can unsubscribe at any time, and we encourage you to read more about our Privacy Policy.

No. 3: Los Cabos, Mexico

Set at the base of the Baja California peninsula, Los Cabos is one of the world’s most popular and desirable destinations. You have the natural beauty of the desert and mountains meeting the sea in dramatic fashion, the perpetually sunny weather, and the stunning beaches. And lining the shores are luxury resorts and residential communities, world-class golf courses, glistening marinas, high-end malls, and fine-dining restaurants.

Since the pandemic, Cabo has seen a massive influx of people. Last year, it welcomed a record 3.86 million air passengers. This year, it’s on track to exceed that figure. Crucially, many of those are coming are staying longer.

I spend time in Cabo every winter. I’ve bought six properties here. I live and breathe this real estate market like almost no other, and I’ve observed firsthand as Cabo has hit a whole new level. There are all sorts of restrictions on

building here, yet people just keep coming.

By leveraging RETA’s group buying power, I’ve been able to bring our members numerous opportunities in Cabo. (See the box above for just one example.) But even with our group buying power and insider connections, deals like these are increasingly hard to find.

In the introduction, I mentioned that certain destinations in the index are deal-specific. Cabo is the prime example of this. Prices will continue to rise here. But this is such a hot market, you need to be selective… find just the right deal at the right entry price.

I’d also advise those interested in Cabo to look at other, emerging markets in Baja California. As Cabo becomes busier and more expensive, money will flow into less-visited destinations on the peninsula, launching what I predict will be a multidecade upswing in places like La Paz (10th on the index).

No. 4: Guanacaste, Costa Rica

Way back before Costa Rica’s tourist boom, the sunny northwestern province of Guanacaste was a sleepy region of cattle farms, empty beaches, and good surf breaks. But a savvy group of developers could see the appeal of this endless-summer location and spent hundreds of millions of dollars building hotels and resorts.

They needed tourists to fill their luxury rooms and pay their premium rates. So soon the airport at Liberia, the provincial capital just 30 minutes from the coast, was expanded and upgraded. In 2002, regular direct flights to the US kick-started a stunning transformation on this coast…

In 2003, Liberia airport saw 50,000 passenger arrivals. Last year, the number hit a record 1.65 million.

Along the way, this region earned the nickname the "Gold Coast."

Get Your Free Costa Rica Report Here

Get Your Free Costa Rica Report Here

Learn more about real estate opportunities in Costa Rica and other countries in our daily postcard e-letter. Simply enter your email address below and we’ll send you a FREE REPORT - Explore the Old World in Laidback Costa Rica.

By submitting your email address, you will receive a free subscription to IL Postcards, Overseas Dream Home, The Untourist Daily and special offers from International Living and our affiliates. You can unsubscribe at any time, and we encourage you to read more about our Privacy Policy.

Today, this is truly one of the world’s up-and-coming high-end havens. You have 5-star resorts like the Four Seasons, the Westin at Reserva Conchal, the JW Marriott at Hacienda Pinilla, and Secrets Papagayo. To spend a single night at these resorts can cost thousands of dollars. New communities like the Waldorf Astoria are selling branded residences for millions and even tens of millions of dollars. In short, this is no longer a low-cost destination, whether you’re buying a home or heading out for dinner.

That said, there is still an incredible opportunity here. Demand on the Gold Coast is huge, but development cannot keep up. Costa Rica is the originator of ecotourism and has set aside vast swathes of land as national parks. There are also lots of restrictions on development. Permitting is tight.

As a result, in the most sought-after coastal locations, supply is scant. Because of this, short-term rentals are thin on the ground and rates are high. So the right home here can be a great investment.

No. 5: Playa del Carmen, Mexico

For many decades, the Caribbean coastal town of Playa del Carmen was little more than a few dusty dirt roads, with rustic accommodations and eateries. Think palapas and even livestock roaming around. But Playa has innate appeal. It boasts white-sand beaches… azure waters… perfect weather…

As the years passed and the resort destination of Cancún, located an hour north, became busier, tourists started to look for quieter alternatives. Services and little businesses began to crop up in Playa. A restaurant here… a little tienda there.

Over time, the sandy streets gradually got paved. Small boutique hotels opened, as did trendy restaurants. Like Cancún before it, this sleepy seaside village transformed into a world-class destination in a matter of decades. But it also followed a different path. Playa became a true city…

Get Your Free Mexico Report Today!

Get Your Free Mexico Report Today!

For more information on real estate opportunities in Mexico and other countries in our daily postcard e-letter. Simply enter your email address below and we’ll send you a free special report on Mexico!

By submitting your email address, you will receive a free subscription to IL Postcards, Overseas Dream Home, The Untourist Daily and special offers from International Living and our affiliates. You can unsubscribe at any time, and we encourage you to read more about our Privacy Policy.

Today, this is the type of place where you can grab an espresso and croissant at a coworking café in the morning… enjoy a lunch of fresh seafood on the beach with your toes in the sand… and have your choice of any number of gourmet options for dinner…

Playa is an "It" spot right now when it comes to world travel. The Riviera Maya overall and Playa del Carmen in particular are two of the most searched international destinations for US travelers. Playa is also a favorite of Canadians and Europeans, not to mention Latin Americans and Mexicans from other parts of the country. It has an enduring appeal to diverse markets, from vacationing families and couples of all ages to groups of friends, snowbirds, expats, and remote workers…

Vacation rentals are in demand pretty much year-round. As my contacts on the ground have told me: "There just doesn’t seem to be a true low season anymore." In other words, this is not a second Cancún. It’s something entirely different. A true beach city where people want to come and live year-round. That means Playa has a very bright future…

Find the right real estate, at the right price, in Playa, and you’ll see huge gains. This remains a destination I’m scouting closely…and a place where I’m constantly hunting for the right deal to bring to my RETA group.

How We Created the RETA 2025 International Real Estate Index

The RETA International Real Estate Index is different from many others you’ll find online or in print for a few reasons…

First, for every destination on the index, I or a member of my team has scouted it in person. My RETA group has been around now for 16-plus years. Today, I have an elite team of handpicked scouts, editors, due diligence experts, accountants, and engineers. We spend more than $1 million on travel and research every year. We put our boots on the ground and our toes in the sand (as the case may be). We meet developers, talk to brokers, and build local contacts. The point being, we’re not just looking at macroeconomic data (though that certainly plays a role), we’re speaking from firsthand experience.

Second, our goal is to identify places that offer both incredible lifestyles and value for money. Often property indexes tend to focus on major economic and financial centers. Think: New York, Paris, London, or Singapore. But destinations such as these typically have very high entry prices and huge holding costs.

The RETA index takes a different approach…

We look for good-value destinations that are growing rapidly and as such have the potential to deliver strong capital appreciation…that welcome investment… that have broad appeal to short-term and long-term renters…and that they offer excellent weather and lifestyles. To be clear, not every destination in the index excels in all of those areas. But most hit at least two or three. To create the index, destinations were ranked across 10 categories. These are:

Relative Value: This can be summarized as "bang for your buck," or what does your money buy you in this market relative to back home. Most destinations listed in the index offer exceptional value when compared to major markets in the US and Canada.

Climate: For this index, higher-scoring markets are warm and sunny, but not humid. This explains why Cabo received a score of 9.5 on climate, while tropical, humid Panama City received a lower, if still strong 7.5. We also made allowances for temperate climates, which are growing in popularity as people look to escape soaring summer temperatures. This explains why destinations like Caminha also scored highly.

International Appeal: This category is a measure of how well-known and popular a destination is among foreign tourists, expats, and the work-from-anywhere, digital nomad crowd. This category also considers how internationalized a market is, covering such factors as flight connections, internet connectivity, and whether visas are required to stay short- or long-term and how easy they are to obtain.

Path of Progress Indicator: A "Path of Progress" is anything that makes a place easier to get to (new roads, airports, or bridges) or more desirable (a 5-star resort in a place that previously only had cheap hostels). If a Path of Progress is moving toward or through a market, it’s a strong indicator of future growth potential.

Income Potential: This is the amount you can expect to earn from renting out a property short- or long-term, relative to the amount invested. Los Cabos and Playa del Carmen score very highly here as high-end rentals are in huge demand in these markets.

Quality of Life: This category considers the availability of dining, shopping, transportation, healthcare, and entertainment options. Also factored in are natural attractions such as beaches and hiking trails.

Ease and Cost of Transaction: This measures how difficult, time-consuming, and expensive the process of purchasing a property is for overseas buyers. Destinations in Italy and Spain received lower scores in this category, since the legal process of purchasing properties in those countries can be slow and expensive. Panama City scores highly since it’s a major global financial center, and banks and real estate professionals are accustomed to working with foreign clients.

Stability: This covers political, economic, and social risk. Is the political environment stable and is it likely to remain so? Is the economy strengthening, or weakening? Are crime, corruption or fraud prevalent? Note that scores in this category reflect the particular destination, not the country where it is located. That’s because factors like crime levels and economic performance can vary significantly within countries.

Availability of Bank Finance: This considers whether banks will provide mortgages to foreign buyers, and if so, how difficult accessing this credit is, and how favorable the terms are.

Holding Costs: This assesses all the costs associated with owning a property in this destination, such as local or national taxes, typical insurance pricing, and common ranges for HOA fees.

Editor’s Note: The full version of the RETA index, featuring 25 destinations and full analysis on each, will be available to RETA members soon. (To learn how you can join RETA and get access to the index and all Ronan’s off-market deals, go here now.)

Free Report: Best Places in the World to Buy Real Estate

Free Report: Best Places in the World to Buy Real Estate

Sign up for International Living's postcards and get the latest research on the best places in the world to retire. Including boots-on-the-ground insights on real estate and rental trends. Simply enter your email address below and we'll send you a FREE report - The World's Best Places to Buy Real Estate.

By submitting your email address, you will receive a free subscription to Your Overseas Dream Home and special offers from International Living and our affiliates. You can unsubscribe at any time, and we encourage you to read more about our Privacy Policy.